From churches to youth organizations to the local chambers of commerce, nonprofit organizations make our communities more livable places. Unlike for-profit businesses that exist to generate profits for their owners, nonprofit organizations exist to pursue missions that address the needs of society. Nonprofit organizations serve in a variety of sectors, such as religious, education, health, social services, commerce, amateur sports clubs, and the arts.

Accounting Free Lessons Online

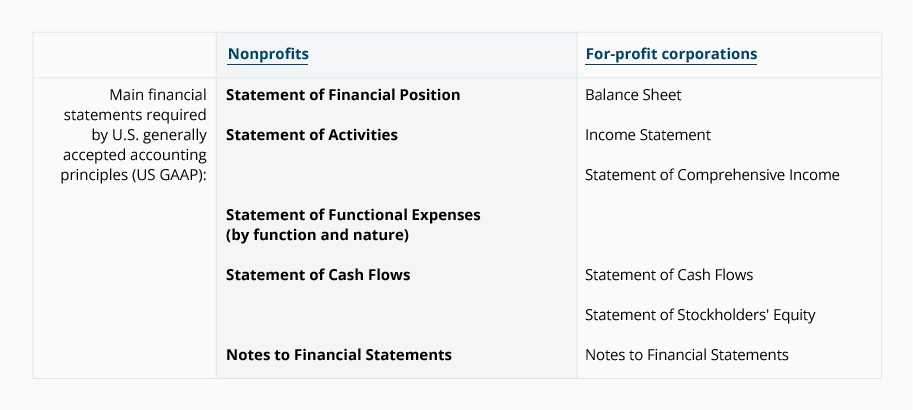

Illustration of the Statement of Financial Position and the Statement of Activities

We are now ready to present examples of the statement of financial position and the statement of activities. To do that, we'll follow the activities of a nonprofit organization called Home4U, a daytime shelter for adults.

Let's assume that Home4U was incorporated in January 2013 and its accounting years will end on each December 31. The following transactions occurred during a three-month period.

Statement of Functional Expenses

The statement of functional expenses is described as a matrix since it reports expenses by their function (programs, management and general, fundraising) and by the nature or type of expense (salaries, rent). For instructional purposes we highlighted the column headings to indicate the expenses by function. We also highlighted the words in the first column as they indicate the nature or type of expenses.

Introduction to Payroll Accounting

It's a fact of business—if a company has employees, it has to account for payroll and fringe benefits.

In this explanation of payroll accounting we'll introduce payroll, fringe benefits, and the payroll-related accounts that a typical company will report on its income statement and balance sheet. Payroll and benefits include items such as:

Salaries, Wages, & Overtime Pay

In this section of payroll accounting we focus on the gross amounts earned by the employees of a company.

Salaries

Salaries are usually associated with "white-collar" workers such as office employees, managers, professionals, and executives. Salaried employees are often paid semi-monthly (e.g., on the 15th and last day of the month) or bi-weekly (e.g., every other Friday) and their salaries are often stated as a gross annual amount, such as "$48,000 per year." The "gross" amount refers to the pay an employee would receive before withholdings are made for such things as taxes, contributions to United Way, and savings plans.

Payroll Withholdings: Taxes & Benefits Paid by Employees

This section of payroll accounting focuses on the amounts withheld from employees' gross pay. (In Part 4 of payroll accounting we will discuss the payroll taxes that are not withheld from employees' gross pay.)

Payroll Taxes, Costs & Benefits Paid by Employers

In addition to salaries and wages, the employer will incur some or all of the following payroll-related expenses:

- Employer portion of Social Security tax

- Employer portion of Medicare tax

- State unemployment tax

- Federal unemployment tax

- Worker compensation insurance

- Employer portion of insurance (health, dental, vision, life, disability)

- Employer paid holidays, vacations, and sick days

- Employer contributions toward 401(k), savings plans, & profit-sharing plans

- Employer contributions to pension plans

- Post-retirement health insurance

Examples of Payroll Journal Entries For Wages

NOTE: In the following examples we assume that the employee's tax rate for Social Security is 6.2% and that the employer's tax rate is 6.2%. (During the years 2011 and 2012 only, the employee's rate was reduced to 4.2%.)

In this section of payroll accounting we will provide examples of the journal entries for recording the gross amount of wages, payroll withholdings, and employer costs related to payroll.

Examples of Payroll Journal Entries For Salaries

Note: In the following examples we assume that the employee's tax rate for Social Security is 6.2% and that the employer's tax rate is 6.2%. (During 2011 and 2012 only, the employee's rate was reduced to 4.2%.)

Let's assume our company also has salaried employees who are paid semimonthly on the 15th and the last day of each month. The pay period for these employees is the half-month that ends on payday. There is one salaried employee in the warehouse department with a gross salary of $48,000 per year, or $2,000 per pay period. There are four salaried employees in the Selling & Administrative Department with combined salaries of $9,000 per pay period.

Sample Transactions #4 - #6

Sample Transaction #4

The fourth transaction occurs on December 3, when a customer gives Direct Delivery a check for $10 to deliver two parcels on that day. Because of double entry, we know there must be a minimum of two accounts involved—one of the accounts must be debited, and one of the accounts must be credited.

Sample Transactions #2 - #3

Sample Transaction #2

Marilyn illustrates for Joe a second transaction. On December 2, Direct Delivery purchases a used delivery van for $14,000 by writing a check for $14,000. The two accounts involved are Cash and Vehicles (or Delivery Equipment). When the check is written, the accounting software will automatically make the entry into these two accounts.

Statement of Cash Flows

The third financial statement that Joe needs to understand is the Statement of Cash Flows. This statement shows how Direct Delivery's cash amount has changed during the time interval shown in the heading of the statement. Joe will be able to see at a glance the cash generated and used by his company's operating activities, its investing activities, and its financing activities. Much of the information on this financial statement will come from Direct Delivery's balance sheets and income statements.

Balance Sheet - Liabilities and Stockholders' Equity

(B) Liabilities

The balance sheet reports Direct Delivery's liabilities as of the date noted in the heading of the balance sheet. Liabilities are obligations of the company; they are amounts owed to others as of the balance sheet date. Marilyn gives Joe some examples of liabilities: the loan he received from his aunt (Notes Payable or Loan Payable), the interest on the loan he owes to his aunt (Interest Payable), the amount he owes to the supply store for items purchased on credit (Accounts Payable), the wages he owes an employee but hasn't yet paid to him (Wages Payable).

The balance sheet reports Direct Delivery's liabilities as of the date noted in the heading of the balance sheet. Liabilities are obligations of the company; they are amounts owed to others as of the balance sheet date. Marilyn gives Joe some examples of liabilities: the loan he received from his aunt (Notes Payable or Loan Payable), the interest on the loan he owes to his aunt (Interest Payable), the amount he owes to the supply store for items purchased on credit (Accounts Payable), the wages he owes an employee but hasn't yet paid to him (Wages Payable).

Balance Sheet - Assets

Marilyn moves on to explain the balance sheet, a financial statement that reports the amount of a company's (A) assets, (B) liabilities, and (C) stockholders' (or owner's) equity at a specific point in time. Because the balance sheet reflects a specific point in time rather than a period of time, Marilyn likes to refer to the balance sheet as a "snapshot" of a company's financial position at a given moment. For example, if a balance sheet is dated December 31, the amounts shown on the balance sheet are the balances in the accounts after all transactions pertaining to December 31 have been recorded.

Subscribe to:

Posts (Atom)